Originally scheduled for release on October 1st, the application will now be available as late as December 1st for some. This delay comes on the four-year anniversary of the passage of the bipartisan FAFSA Simplification Act, a timeframe during which the Department had ample time to perfect the system. Instead, the Department was and continues to be hyper-focused on the illegal student loan bailout.

This situation underscores the urgent need for legislative action, which is why I introduced the FAFSA Deadline Act earlier this Summer. This act would prevent such delays in the future, ensuring that students and families are not subjected to unnecessary burdens and uncertainty. It is imperative that the Department of Education fulfills its obligations in a timely and efficient manner, and be held accountable when they don’t.” – Rep. Erin Houchin

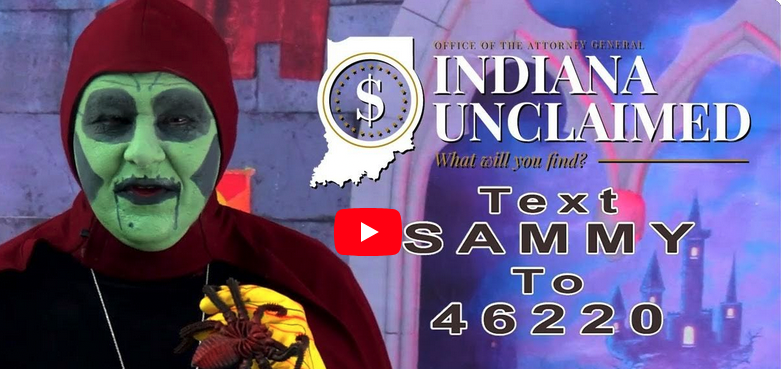

Indiana Attorney General Todd Rokita continues successful partnership with the longest running TV horror host in the world, Sammy Terry, to treat Hoosiers with more than funnel cakes during this year's Indiana State Fair.

“Visiting the State Fair and watching Sammy Terry are family traditions for so many Hoosiers,” Attorney General Todd Rokita said. “That’s why I'm proud to continue our successful partnership with Sammy Terry to reunite Hoosiers with their hard-earned unclaimed funds.”

Fairgoers can meet Sammy Terry at the Attorney General’s booth on Saturday, August 17th from 1:00pm ET – 6:00pm ET in the Mercantile Building. Team members will be available to assistHoosiers with unclaimed property searches. Staff will also have information and tips to help consumers protect themselves from identity theft and other scams.

“The only thing more horribly fun than bringing family friendly horror movies to Hoosiers each week is helping Indiana Unclaimed return millions of dollars to my Horror-able fellow Hoosiers,” said Sammy Terry.

AG Rokita’s team reunited one Hoosier family with $160,000 at the State Fair last year. The Attorney General’s Office has returned over $48,000,000 so far this year and much more is just waiting to be claimed. Don’t miss your chance to claim what is rightfully yours!

Representatives from the Attorney General’s Office will be at the Indiana State Fair every day from 9:00am ET – 8:00pm ET. The State Fair runs through Sunday, August 18th and is closed on Mondays.

Recovering your unclaimed property is safe, secure and simple. Attorney General Rokita recommends Hoosiers text “SAMMY” to “46220” or visit indianaunclaimed.gov and check for these types of property that might go unclaimed:

- Unclaimed wages or commissions

- Money orders

- Safety deposit box contents

- Savings and checking accounts

- Refunds

- Overpayments such as:

- Credit card balances

- Cell phone bills

- DMV payments

You may also like and/or follow the Unclaimed Property Division on Facebook. Make sure you keep an eye out for Sammy Terry’s reminders. Even he knows it’s ghoulishly fun to search for unclaimed property.

WASHINGTON – U.S. Senators Todd Young (R-Ind.), Mike Braun (R-Ind.), Sherrod Brown (D-Ohio), and Roger Marshall (R-Kan.), along with a bipartisan group of colleagues, called on the Biden Administration to block taxpayer money from being used to subsidize biofuels produced using imported foreign feedstocks such as Chinese used cooking oil and Brazilian ethanol.

In a letter to Treasury Secretary Janet Yellen, the senators called on the Administration to restrict the eligibility of the forthcoming 45Z Clean Fuel Production Credit to renewable biofuels fuels made from feedstocks sourced domestically. The tax credit is intended to make America more energy independent and spur the production of biofuels made with American-produced feedstocks – building new markets for American farmers.

The letter comes amidst a surge in imports of Chinese used cooking oil being used to produce biofuels in the U.S. that is displacing the use of domestic feedstocks. The senators warned that a poorly crafted rule will hurt American farmers, undermine the American biofuel industry’s competitiveness, and undercut American energy independence.

“As Treasury works to craft 45Z guidance, we urge you to restrict the eligibility to renewable fuels made from feedstocks sourced domestically,” the senators wrote. “If drafted and implemented correctly, the credit will help to support robust American energy independence—incentivizing the production of biofuels made with domestically-produced feedstocks. In order to ensure this objective, it is essential that the 45Z rule articulate clear, workable pathways for domestically-produced renewable fuels derived from domestically-produced feedstocks.”

In addition to Senators Young, Braun, Brown, and Marshall, Senators Jerry Moran (R-Kan.), Richard Durbin (D-Ill.), Tammy Duckworth (D-Ill.), Deb Fischer (R-Neb.), Pete Ricketts (R-Neb.), Tammy Baldwin (D-Wis.), Joni Ernst (R-Iowa), Amy Klobuchar (D-Minn.), Tina Smith (D-Minn.), and Eric Schmitt (R-Mo.) also signed the letter.

Full text of the letter can be found here and below:

Dear Secretary Yellen:

It is critical to American energy independence and rural prosperity that the Department of the Treasury (Treasury) issue proposed and subsequently final guidance for the Clean Fuel Production Credit (45Z) in advance of its January 1, 2025, statutory deadline. Finalizing this rule in a timely manner will provide farmers, renewable fuel producers, end-users, and other biofuels stakeholders with the certainty and clarity they need to invest and make planting decisions. As Treasury works to craft 45Z guidance, we urge you to restrict the eligibility to renewable fuels made from feedstocks sourced domestically.

45Z is intended to stimulate the development of a domestic, low-carbon fuel supply chain and to increase American competitiveness in the renewable and traditional energy markets. If drafted and implemented correctly, the credit will help to support robust American energy independence—incentivizing the production of biofuels made with domestically-produced feedstocks. In order to ensure this objective, it is essential that the 45Z rule articulate clear, workable pathways for domestically-produced renewable fuels derived from domestically-produced feedstocks, to lead the way in lowering the carbon intensity of American transportation fuels.

While the use of foreign feedstocks can play an important role in producing domestically manufactured ethanol and biodiesel, the rule must make it clear that the tax credit may only apply to biofuels produced from domestic feedstocks. This would be keeping with the two-fold intent of Congress in creating 45Z: 1) support domestic biofuels manufacturing, and 2) utilize domestic feedstocks to lead the way in lowering the carbon intensity of American transportation fuels. This approach marks a deliberate change from the previous Blenders Tax Credit, and it is important that Treasury’s guidance capture this nuance and accurately reflect Congressional intent.

Failure to properly structure the feedstock sustainability criteria associated with 45Z credit will incentivize the use of foreign feedstocks over those from U.S. suppliers, contrary to the intent of Congress. If the guidance fails to establish robust, science-based, sustainability criteria that producers of domestic feedstocks can actually meet, and fails to include guardrails that ensure the credit is only available to renewable fuels made with domestically produced feedstocks, renewable fuel producers will take the path of least resistance and import foreign feedstocks, such as used cooking oil (UCO) from China to produce renewable diesel or Brazilian ethanol as a feedstock for sustainable aviation fuel (SAF) in the U.S. This would reduce the utility of the credit to a manufacturing credit, rather than a credit that supports both manufacturing and feedstock production. This was not the intent of Congress.

One need look no further than the dramatic increase in imports of Chinese UCO and Brazilian tallow, and the current use of Brazilian ethanol in producing SAF to understand the consequences of a failure to properly craft the 45Z tax credit in a manner that supports American feedstocks. This has occurred, in part, because under the current guidance for the 40B tax credit for sustainable aviation fuel, no domestically-produced ethanol is able to achieve the criteria set forth by the Treasury Department. This has unintended and counterproductive consequences.

We are deeply concerned that if the Administration fails to address the current market dynamics of foreign UCO, tallow and ethanol, and Brazilian trade barriers for American ethanol, American agriculture will have a limited role in decarbonizing the transportation system. American agriculture, in search of new and robust markets, has been the chief advocate for biofuels adoption. A poorly constructed rule will deny American farmers the long-anticipated benefit of biofuel adoption, which would be unacceptable.

If more is not done to support the production and utilization of domestic feedstocks, the U.S. will see its renewable fuels industry shift focus from domestically oriented feedstocks towards imports. Allowing U.S. tax credits to fund the importation and use of foreign feedstocks to produce biofuels would put U.S. agriculture at the back of the line, while foreign agricultural producers are subsidized by U.S. taxpayers.

We urge you to issue proposed and subsequently final guidance for 45Z in advance of January 1, 2025. Such a rule should include language that only allows for the distribution of federal tax dollars to renewable fuel made with domestic feedstocks as Congress intended.

Sincerely,

Thus declared a U.S. district court this week as it ruled in favor of plaintiffs — Indiana, 51 other states and territories, and the U.S. Department of Justice — who sued the Big Tech giant over its illegal monopolistic misconduct in connection with its search function and search text advertising.

In Indiana, Attorney General Todd Rokita and his team played a leading role in coordinating the efforts of the plaintiff states litigating with the U.S. Justice Department’s Antitrust Division against Google in this case.

“From day one, I have made clear that my office would not tolerate Big Tech riding roughshod over the rights and interests of everyday Hoosiers,” Attorney General Rokita said. “Once again, we are making good on this commitment. We are holding Google accountable for its illegal and unacceptable practices.”

The court’s decision finds that Google has used exclusive distribution agreements to limit competition for online search services, depriving users of innovative alternatives and enabling Google to charge supracompetitive prices for general search text ads relied upon by many businesses in Indiana and beyond.

Under Attorney General Rokita’s leadership, Indiana — which was one of 11 plaintiff states to join the federal government’s initial monopolization case against Google — continued its efforts to litigate this groundbreaking case from start to finish for the benefit of consumers.

“These companies are not permitted to preserve their market dominance through exclusionary tactics,” Attorney General Rokita said. “Rather, they must compete in the free market to maintain the favor of their customers.”

United States Senator Mike Braun's bills to become law or pass Senate in the 118th Congress (2023-2024) are:

(Became Law) The Federal Prison Oversight Act

- A bill to provide independent oversight to improve conditions for staff and prisoners in federal prisons like Terre Haute.

(Became Law) COVID-19 Origins Act

- A bill that required the intelligence community to declassify important information about the origins of COVID, specifically the Wuhan Institute of Virology.

(Became Law) The Wounded Warrior Access Act

- A bill that streamlines the claims process for veterans with a new online tool, helping those who previously had to get their claims information through the mail or by driving to a regional VA location.

(Became Law) Department of Defense Overdose Data (DOD) Act

- A bill to ensure naloxone and any other medication to reverse opioid overdose is available on all military installations and in each operational environment.

(Became Law) Reforming Benefits for Children of Vietnam Veterans with Spina Bifida

- A bill to help the children of Vietnam Veterans suffering from spina bifida due to their father’s exposure to Agent Orange get access to medical benefits for the rest of their lives

(Became Law) Administrative Pay-As-You-Go Act

- A bill which requires agencies to propose pay-fors to offset expensive government regulations.

(Passed Senate) VA Home Loan Awareness Act

- A bill to inform veteran homebuyers of their eligibility for the VA Home Loan Program, which helps more veterans achieve the dream of homeownership.

(Passed Senate) Working Dog Health and Welfare Act of 2023

- A bill to improve conditions for dogs used in the detection of explosives, narcotics and patrol duties by federal agencies, by instituting programs that detect abuse and neglect and ensure emergency medical care, food and water, and rest time.

(Passed Senate) Mark Our Place Act

- A bill to provide special headstones upon family request for all veterans who have received the Medal of Honor.

If signed into law, the National Fossil Act will join the following Braun bills signed into law:

BILLS SIGNED INTO LAW IN THE 118TH CONGRESS (2023-2024).

- Federal Prison Oversight Act

- The COVID-19 Origins Act (Public Law 118-2)

- The Administrative Pay-As-You-Go Act (included in Public Law 118-5)

- Reforming Benefits for Children of Vietnam Veterans with Spina Bifida (Public Law 118-8)

- The Wounded Warrior Access Act (Public Law 118-21)

- The Korean American VALOR Act (Public Law 118-20)

- The Department of Defense Overdose Data (DOD) Act (Public Law 118-31)

- Supporting the Provision of Veteran Survivor Benefit Plans (Public Law 118-31)

- Flexibility and Funding for the World Trade Center Health Program (Public Law 118-31)

BILLS SIGNED INTO LAW IN THE 117TH CONGRESS (2021 - 2022):

- Hire Veteran Health Heroes Act of 2021 (Public Law 117-67)

- A bill to properly implement the ALS Disability Insurance Access Act (Public Law 117-3)

- The Consider Teachers Act (Public Law No: 117-49)

- The Growing Climate Solutions Act (Public Law 117-328)

- The STREAM Act (Public Law 117-328)

- Small Business Establishment Registration Waiver Act (Public Law 117-328)

- The Make It in America Act (Public Law 117-58)

- The DUMP Opioids Act (Public Law 117-29

- Better ODDS to Reduce Diversion Act of 2021 (Public Law 117-328)

- FREED of Opioids Act (Public Law 117-328)

- The Access for Veterans to Records Act (Public Law 117-328)

- Women Who Worked on the Home Front World War II Memorial Act (Public Law 117-328)

- Apply the Science Act (Public Law 117-328)

- The Emergency Use Transparency Act (Public Law 117-328)

- The Recovery Startup Assistance Act (Public Law 117-328)

- Promoting Access to Critical Countermeasures by Ensuring Specimen Samples (ACCESS) to Diagnostics Act (Public Law 117-328)

- Predetermined Change Control Plan Act (Public Law 117-328)

- Protecting Patients from Counterfeit Medical Devices Act (Public Law 117-328)

- The PLUM Act (Public Law 117-328)

BILLS SIGNED INTO LAW IN THE 116TH CONGRESS (2019 - 2020):

- The Safeguarding Small Business Act

- Healthcare Transparency

- the Whistleblower Act of 2019

- the VA Directly Returning Opioid Prescriptions Act

- the Stop Student Debt Relief Scams Act of 2019

- Restore Harmony Way Bridge Act

- Richard Lugar Post Office Act

- Payment Integrity Information Act

- ALS Disability Insurance Access Act

- OTC Reform

- The Fair Care Act

- Braun Provisions in the WRDA Reauthorization in the OMNI

SalemLeader.com

Leader Publishing Company of Salem, Inc.

P.O. Box 506

117-119 East Walnut Street

Salem, Indiana. 47167

Phone: 812-883-3281 | Fax: 812-883-4446

Business Hours:

Mondays through Fridays, 9:00am - 5:00pm

News:

news@salemleader.com

Office:

office@salemleader.com

Publisher:

publisher@salemleader.com

Business

- More Business News

- Go To Guide

- Business Directory

- Real Estate

- Auctions

Education

- More Education News

Opinion

- Editorials

- Letters to the Editor

- Columns

- Unsung Heroes

- Days Gone By

- In the Garden

- Guest Columns

- Reader's Poll

- Salem Leader Forum

- Questions and Answers

Church

- Bible Aerobics

- Church News

- Church Directory